📚 Somos más que una firma financiera:

Donde la educación financiera y el crecimiento empresarial se unen para transformar vidas

Somos educadoras, mentoras y guías en tu camino hacia la libertad empresarial.

¿QUÉ HACEMOS?

En Quantum Business and Education Advisors, entendemos que detrás de cada emprendedor hay un sueño, una historia y una necesidad urgente de claridad y apoyo. Por eso, combinamos asesoría estratégica con educación transformadora, para que no solo consigas financiamiento, sino que aprendas a crear, sostener y escalar tu negocio con confianza y visión.

NUESTRA MISIÓN

Empoderar a emprendedores y empresarios

en todo Estados Unidos con herramientas educativas y soluciones financieras reales, prácticas y personalizadas, que les permitan tomar el control de su crecimiento, incluso cuando el sistema tradicional les ha cerrado las puertas.

Nuestras Soluciones Educativas y Financieras

📌 Consultoría financiera personalizada

📌 Mentoría educativa para emprendedores

📌 Acceso a líneas de crédito y fondeo alternativo

📌 Programas educativos sobre crédito e inversión

📌 Especialistas en industrias de alto riesgo

Incluso cuando el sistema tradicional dice NO, nosotras encontramos el SÍ.

¿Sueñas con emprender o hacer crecer tu negocio, pero sientes que el sistema no te apoya?

🔸 ¿No sabes por dónde empezar como emprendedor?

🔸 ¿Los bancos te han dicho que “no”?

🔸 ¿Tu historial crediticio te ha cerrado oportunidades?

🔸 ¿Sientes que nadie te explica con claridad cómo acceder al financiamiento? En Quantum Business and Education Advisors, no solo te damos soluciones…

Te educamos para que tú seas la solución.

Somos Educadoras Financieras, Mentoras Estratégicas y Consultoras Reales

Nuestro enfoque único combina:

✔ Educación financiera accesible

✔ Asesoría personalizada

✔ Acceso a capital privado

✔ Estrategias para negocios reales (incluso de alto riesgo)Porque entender tu negocio es tan importante como financiarlo

¿Quiénes están detrás de Quantum?

Somos una firma educativa y financiera liderada por mujeres comprometidas con el progreso empresarial hispano. En Quantum Business and Education Advisors, no solo asesoramos: formamos líderes conscientes, con herramientas reales, visión empresarial y apoyo constante.✨ Te escuchamos. Te guiamos. Y caminamos contigo hasta que logres tus metas.

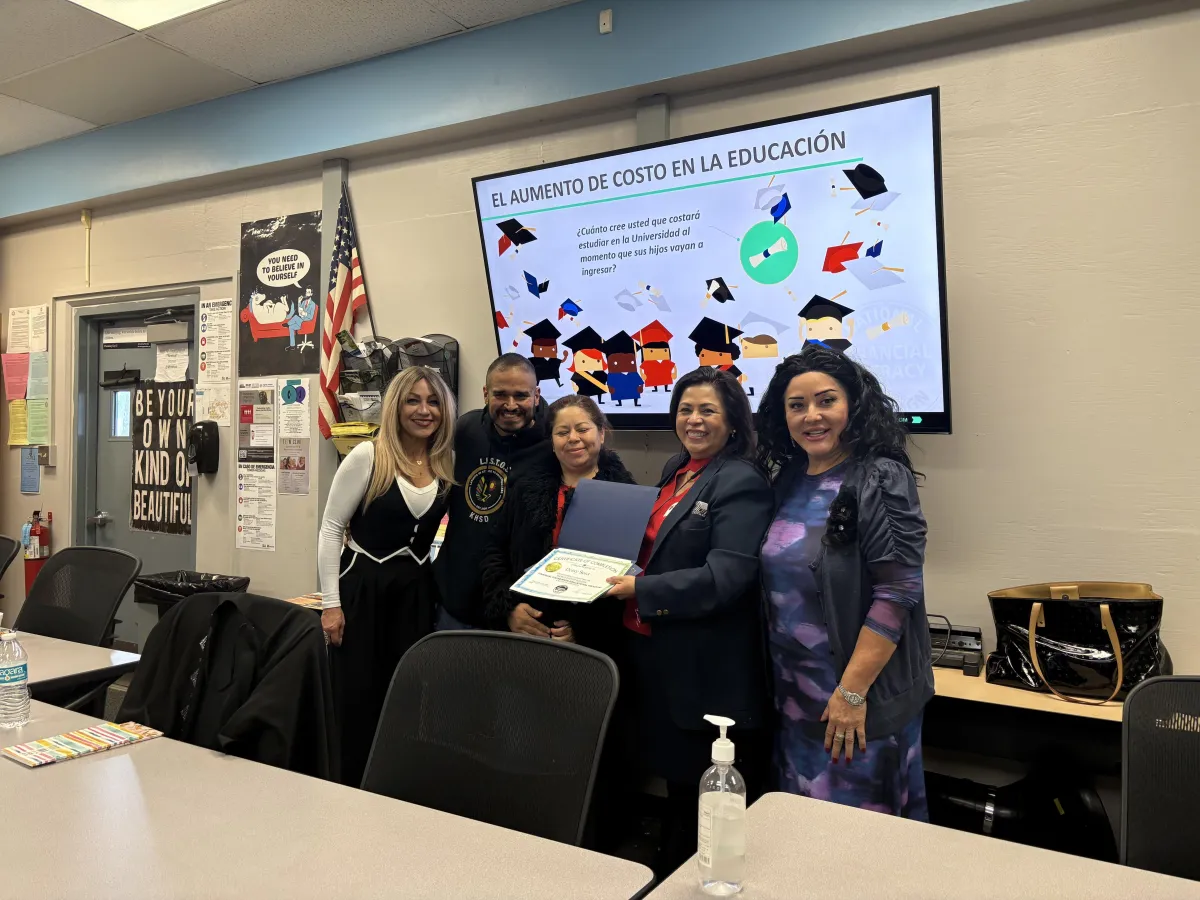

María Elena Hernández

Soy una profesional con más de 35 años de experiencia en seguros, bienes raíces, préstamos y consultoría de negocios, así como una apasionada educadora en finanzas personales y bienes raíces.

Como fundadora y CEO de QUANTUM BUSINESS AND EDUCATION ADVISORS, LLC, mi misión es capacitar a las comunidades, brindándoles las herramientas necesarias para tomar decisiones informadas sobre bienes raíces y finanzas.

He diseñado una serie de talleres educativos enfocados en empoderar a las personas, para lograr seguridad financiera y éxito empresarial.

Angélica Denysse Aguilar Luna

Estudió Ingeniería Industrial, en su País natal, pues es originaria de Mexicali, BC Norte, México, donde trabajó como ingeniera en Sony en Mexicali, se desempeñó en el sector de bienes raíces en la misma ciudad, y fue gerente de Avon México.

En 2017 se mudó a Estados Unidos, donde continuó su educación en Business y Finanzas, así como en Real Estate. Ha participado activamente en actividades de voluntariado. Ha trabajado con Dignity Health y Promotoras con Alma, y actualmente es facilitadora en Piqe. En este rol, ayuda a los padres a empoderarse con información para que sus hijos puedan desarrollar al máximo sus habilidades y aprovechar los recursos disponibles para sus estudios.

Talleres de Educación Financiera

para Jóvenes

Empoderar a los jóvenes con habilidades financieras prácticas para que puedan tomar decisiones inteligentes sobre el dinero, evitar deudas innecesarias y construir un futuro financiero sólido desde temprana edad.

Módulo 1: Fundamentos del Dinero y Mentalidad Financiera

✅ ¿Qué es el dinero y cómo funciona en nuestra sociedad?

✅ La diferencia entre necesidades y deseos.

✅ La importancia de la educación financiera desde temprana edad.

✅ Cómo nuestras creencias sobre el dinero influyen en nuestras decisiones.

🎯 Meta: Ayudar a los jóvenes a comprender la importancia del dinero y adoptar una mentalidad de abundancia y responsabilidad financiera.

Módulo 2: Cómo Administrar el Dinero y Crear un Presupuesto

✅ Regla del 50/30/20: Cómo distribuir sabiamente los ingresos.

✅ Cómo crear un presupuesto mensual y gestionar gastos fijos y variables.

✅ Herramientas y aplicaciones para monitorear las finanzas personales.

✅ ¿Qué hacer con tu primer sueldo o dinero de beca?

🎯 Meta: Enseñar a los jóvenes cómo administrar eficazmente su dinero y desarrollar hábitos financieros sólidos.

Módulo 3: Evitando Deudas y Construyendo Buen Crédito

✅ ¿Cómo funcionan las tarjetas de crédito y los préstamos?

✅ Los riesgos de la deuda estudiantil y cómo evitarlos.

✅ Estrategias para construir un buen crédito desde los 18 años.

✅ Cómo evitar fraudes financieros y estafas en línea.

🎯 Meta: Asegurar que los jóvenes aprendan a evitar deudas innecesarias y usar el crédito de manera responsable.

Módulo 4: Generación de Ingresos, Ahorro y Mentalidad Emprendedora

✅ Cómo ganar dinero desde temprana edad: trabajos, freelance y emprendimiento.

✅ Estrategias para iniciar un pequeño negocio o emprendimiento digital.

✅ Habilidades laborales del futuro: ¿qué carreras serán más rentables?

✅ Cómo usar las redes sociales y la tecnología para generar ingresos.

🎯 Meta: Inspirar a los jóvenes a ser financieramente independientes y desarrollar formas creativas de generar ingresos.

Módulo 5: Planeación Financiera para el Futuro

✅ Cómo planificar estudios universitarios sin endeudarse.

✅ Estrategias para pagar la universidad sin préstamos estudiantiles.

✅ Beneficios de tener un plan financiero desde los 18 años.

✅ Cómo establecer metas financieras a corto, mediano y largo plazo.

🎯 Meta: Ayudar a los jóvenes a desarrollar un plan financiero claro y realista para construir un futuro libre de deudas.

No te preocupes, ¡podemos ayudarte!

💡 Metodología del Taller

📌 Clases dinámicas e interactivas: ejemplos reales, discusiones y simulaciones financieras.

📌 Actividades prácticas: Los estudiantes crearán presupuestos, analizarán casos de estudio y explorarán oportunidades de inversión.

📌 Juegos y desafíos financieros: Aplicaciones divertidas para aprender a administrar el dinero.

📌 Acceso a recursos digitales: Guías, plantillas de presupuesto y herramientas financieras en línea para uso personal.

🎯 Beneficios para los Jóvenes

✅ Aprenderán habilidades financieras que no se enseñan en la escuela.

✅ Evitarán la deuda estudiantil y tomarán decisiones informadas sobre préstamos.

✅ Desarrollarán una mentalidad inversora y estrategias para crear riqueza.

✅ Ganarán seguridad financiera y confianza en el manejo del dinero.

Copyright © 2025 | Quantum Business Advisors™